-

“Why is a multi-family home a better buy to let investment than a single-family home”

“Why is a multi-family home a better buy to let investment than a single-family home”

If you’re looking to actively invest in residential property, most investors will consider two types: single-family home or multi-family home. With single-family, you’d be buying traditional homes built for one family or household. On the multi-family side, you’d be buying apartment buildings. Both are very attractive and popular but investors need to consider there are significant differences in terms of cashflow, risks, maintenance and returns on investment. We have explored some of these points below.

In single-family homes there is not a strong cash flow (unless you own several properties). Fewer units means less cash. You’re only getting a handful of rent payments per month, and a large chunk of those are going toward your mortgage, maintenance costs, and admin fees. However in multi-family homes you have a better cash flow and a bigger financial cushion. The extra cash that comes with multi-family real estate can help safeguard you from loss. There’s more room for error, and you may have more capital to further grow your investing business if you do it right.

“Buying a multi-family home means an instant real estate portfolio”

If you’re looking to build a big real estate portfolio single-family homes are not the way to go. A portfolio of 10 units would mean 10 negotiations, 10 mortgage applications, and 10 closings, and it would take much more time compared to multi-family properties which let you scale up with just one purchase. Buying a multi-family home means an instant real estate portfolio. You’ll have at least several units on your hands, and having the cash flow and profits that come with it isn’t such a bad thing either!

“If a tenant moves out of a single-family rental, it is 100% vacant”

Yes single-family homes are a lot easier to acquire but when it comes to growth this would be slower than the multi-family homes. Also one of the disadvantages of a single-family homes is that if the property is vacant you would have zero income until the management company replaces the tenants whereas with a multi-family home they can lose a tenant but can still produce an income with the other occupied units. It is rare to see a multi-family home totally vacant. Multi-family rental owners are also far less likely to have zero rental income. If a tenant moves out of a single-family rental, it is 100% vacant. On the other hand, if a multi-family rental owner loses a tenant, its only 10% vacant. Even after that reduction in cash flow, you’ll still have 90% of your regular monthly rental income to cover the property’s mortgage and operating costs.

In single-family homes, if you want to make repairs or improvements to the building it only increases the value of that one property as opposed to many in a multi-family property. Financing the purchase of multi-family homes is much easier than of single-family investment properties. The return on investment received by investing in single-family rentals tends to be higher than from other rental types; however, banks are more easily persuaded to give a mortgage to real estate investors for multi-family properties due to the risks being lower.

When you base it on a per-unit basis, the cost of constructing a multifamily property is more affordable than other types of real estate properties. It is, therefore, a more cost-efficient investment and relatively risk-free for first-time investors. If you choose to apply for a mortgage loan to build or purchase this type of property, you can expect lower mortgage financing rates.

The foreclosure rate on apartment buildings or other types of multifamily properties is lower as compared to a single-family unit. This explains why mortgage lenders can offer competitive rates for investors of this type of property. This reduces operating costs which will bring more revenue in the long run.

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email:info@spirecapital.ie

Author: Deirbhile Finn-Healy

-

Dublin Property Impact: The Benefit of Brexit

Dublin Property Impact: The Benefit of Brexit

There’s no doubt that there will be a big impact of Brexit throughout the EU’s economy with the UK being predicated by many as the biggest loser. But who will be the biggest winner? In this piece of analysis I will outline why I believe Dublin city centre and particularly the IFSC micro-economy will benefit, and how this will impact on the property market in this area.

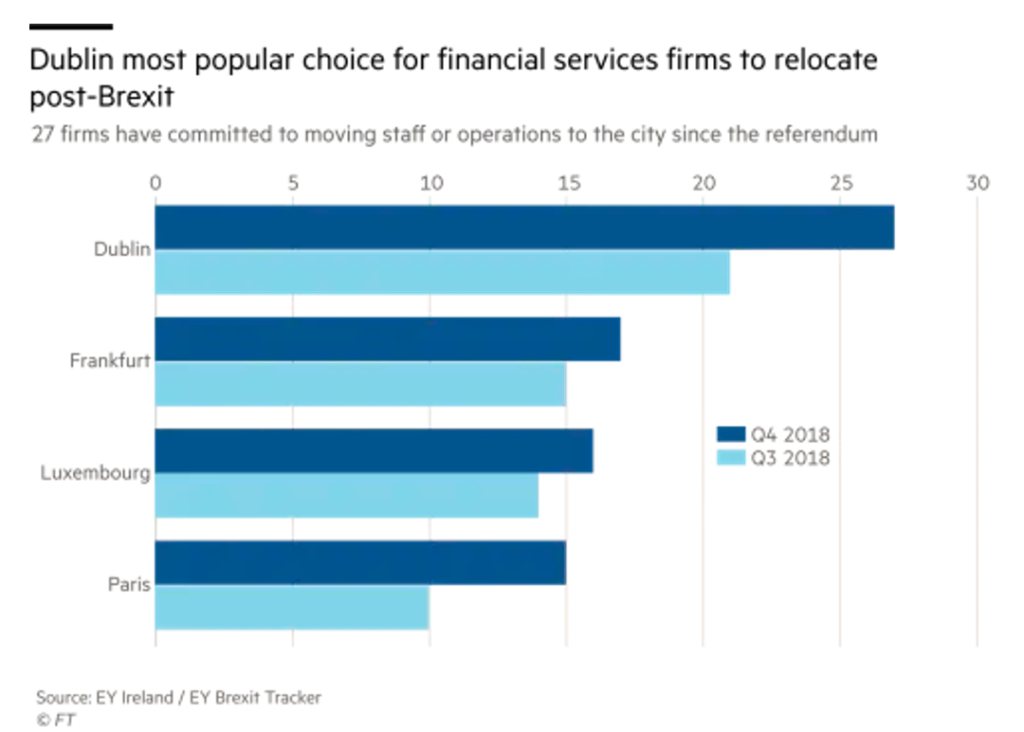

Global companies choose Dublin for access to European Financial Markets

According to EY, Dublin is the preferred location in Europe for both global companies looking to grow by access the European markets, and also by UK companies looking to maintain access to this market. But why Dublin?

Post-Brexit, Ireland will be the only country in the EU which will have English as its primary language which makes it a priority location for US, UK and Asian companies whose corporate language is English. Add into the mix the young, highly-educated multi-lingual workforce available in Dublin, its attractive corporate tax status, pro-business financial regulation and it’s easy to see why Dublin is a very compelling argument for international banks and insurance companies to have their EU HQ there.

By setting up in Dublin, financial services companies can passport their products and services throughout the EU without the need for governmental regulation in each separate country. So if an Asian or American fund wants to enter the European financial services, they would just set up a European HQ or “hub”, and then distribute throughout the other jurisdictions. Similarly the UK, which has pre-Brexit access to these markets, but after Brexit these rights will be removed, irrespective of Deal or No Deal.

This is why Dublin is the no.1 location for UK financial services companies looking to move more assets and staff to Dublin to maintain access to the important European markets.

It’s no secret that companies like Barclays, JP Morgan, Bank of America have invested heavily in Dublin for the long-term. They have moved billions of euro in capital, and have also entered long term office leases as they transfer their highly paid UK workers to Dublin and hire additional local staff. For example, in 2019 Barclays Bank moved €190bn worth of assets to Ireland, with UK-based workers to follow.

The IFSC isn’t a short term fad, but is a long term government backed strategy to provide simplified and stable access to European financial services markets. From humble beginnings back in the early 1990s, Dublin’s International Financial Service’s Centre (IFSC) has now over €5 trillion worth of asset under administration. The global bank Citibank have a presence in Dublin for over 50 years and which now employers over 9,000 at its European hub. Their competitors also have a large presence in Dublin including J.P. Morgan (c.1,000 employees), State Street (c. 2,500), BNY Mellon (c.1,700).

IFSC Fun Facts and Figures

- 500+ banks, insurers, finance and fund service companies

- Over 1,000 different fund managers

- Average salary of €60,100 (c. €3,500 net per month)

- Total Direct Employment of over 38,000

- Comprises 5% of all EU 27 cross-border financial services activity

- All the global advisers: KPMG, EY, Grant Thornton, Deloitte, PwC

- All the global legal firm: Dentons, Walkers, DLA Piper

Brexit Impact on Dublin Property Market

As more companies are attracted to Dublin because of Brexit, this will increase the demand for both local talent and the demand for local rental housing. This will mean that salaries will and rent will both rise.

The influx of overseas workers has exacerbated Dublin’s already chronic housing shortage and has led to very high demand for rental accommodation. As property prices are growing slower than the rate of the rents, the result is that Dublin has now the highest rental yields in any major European capital city.

The average cost of a 1 bed apartment in Dublin 1 (which includes IFSC) is €250,000 and generates an average rent of c. €1,605 resulting in a 7.7% yield. This monthly rent is still less than 50% of an average IFSC workers net income which is affordable considering the high quality, close proximity to their place of work and is often shared with a partner. With new insurers and banks companies coming to Dublin to access the European markets, this is leading to further increases in demand and upward pressure on rent, which is only compounded by the higher than average salaries in the IFSC. So whilst IFSC rents are higher than other parts of the Dublin, the average salaries are higher and increasing at a higher rate than the rents. The result is long queues for newly vacant apartments which I predict will last long after Brexit.

Contact me at colin@spirecapital.ie to see how Spire Capital can help you capitalise on IFSC property market.

Sources: www.spirecapital.ie www.daft.ie www.ifsc.ie www.irishfunds.ie

-

Property management and Investment management in Ireland are two very different professions

Property management and Investment management in Ireland are two very different professions

Spire Capital assists investors with all of the administrative, financial, capital and operations of an assigned portfolio. Our network of Property management partners are focused more on the day to day operational activities such as physical maintenance, repairs and renovations, rent collection, payment of expenses.

Foreign clients often ask: “Why do I need an asset manager? ” or “Why do I need to use a company structure to invest?”, the short answer is “”asset managers are better positioned and more experienced at making investments grow than their clients”.

Property management and Investment management are two very different professions.

Property management concentrates on the day-to-day operations of a property. People who work at specific properties are typically fulfilling property management responsibilities. A property manager maintains the value of a property. Property management includes, but is not limited to:

- Maintenance of the property and facilities

- Renting dwellings, sites, rooms, etc.

- Collecting rent and other charges

- Working with staff and contractors

- Dealing with resident, tenant and guest issues

- Enforcing rules, regulations, covenants, guidelines

- Risk management

Investment management is centred on financial matters; maximizing the return on investment and value of property. They are adept at streamlining operations and repositioning a property to reduce costs and increase income.

Investment managers understand real estate as an investment. Investment management tasks include:

- Prepare long term financial forecasts and perform cash flow analysis and compute internal rate of return in order to determine a property’s financial performance.

- Perform due diligence for acquisition or disposition of property and provide recommendations.

- Determine value of a property and what can be done to increase the value.

- Find and work with lenders.

- Negotiate on behalf of the owner

- Market an asset to increase revenue.

Frequently asked Questions to Investment Managers

1. Why do I need an Irish company to invest through?

there are many equally important reasons/benefits for using a company which include:

- Tax optimisation

- Access to mortgages

- Legally protection for owner

- Investor Privacy/Confidentiality

- Estate planning

- Investment management

Spire Capital establishes and manages investment companies (Propco’s) in Ireland on behalf of its foreign based investors.

2.How can I control the bank account of the company?

Investors have 24/7 online viewing access to the company’s bank account to check the rental income and expenses. As managing directors of the PropCo, Spire Capital will be restricted to only manage the monthly cashflows and banking activities on behalf of the investors as per the pre-agreed Investment management agreement.

3.How often should I come to Ireland?

When Investors initially come to Ireland, Spire capital will assist them to set-up a company and open a company bank account. During this initial visit, Spire Capital will arrange some investment opportunities for review. Once a property has been acquired, Investors will receive regular updates and depending on the size of their investment they would typically visit Ireland once per year for the initial couple of years and once they are satisfied that the investment is meeting their expectations they will usually visit less frequently.

Spire Capital prides itself on a rigorous process of due diligence before selecting an investment into one of our portfolios. This allows us to make successful investment decisions about the ongoing management, rental, and resale of investments

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

Make your money work – Calculating monthly income returns

Make your money work – Calculating monthly income returns

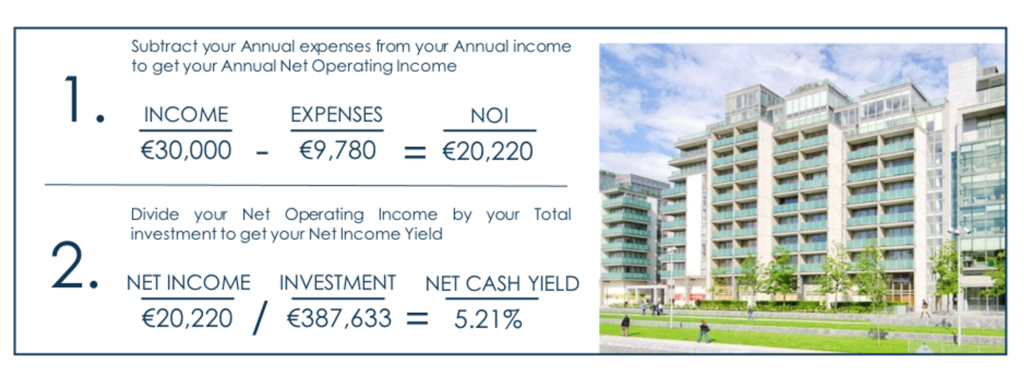

To calculate the return on investment, there are numerous methods and formulas to use. The simplest way to calculate it is to base it on the cash generated as a percentage of the TOTAL amount invested.

Note: Investors are accumulating over €100,000 in Net Operating income over a 5 year term with similar investments.

Returns made from the profit from the sale of the property after 5 years are not included which will increase the overall ROI of the investment significantly. On exit a liquid market is vital and currently exit timelines are 10-12 weeks. Rent increases of 4% p.a. result in 17% increase in net operating income over 5 year period.

Achieving a long-term income generation investment is key to our strategy however these great returns can only be achieved by having an efficient tax optimised structure in place. Spire Capital is achieving similar annual cash returns free of Irish income tax for some of our international clients

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

What annual running costs should an overseas investor consider when investing in a 2 bedroom apartment in Dublin city?

What annual running costs should an overseas investor consider when investing in a 2 bedroom apartment in Dublin city?

To ensure there are no nasty surprises in the first year, allowances should be made for operational running costs, using the most relevant information. Having a direct insight in particular developments in Dublin means highly accurate cash-flows models.

Local property tax:

The annual local property tax (LPT) is annual self-assessed tax charged on the market value of all residential properties in Ireland. The tax due is calculated via a system of market bands.

Tenant Registration Fee:

It is a legal requirement that landlords must register tenancies with the Residential Tenancies Board (RTB). €90 per tenancy provided the completed application to register is received by the RTB within one month from the tenancy commencement date.

House insurance:

Apartment insurance will vary from property to property but we have budgeted €300pa (€25/month) for this type of property. The tenant will usually have their own contents insurance and the landlord will have a special ‘buy-to-let landlord insurance policy’ covering any accidental damage inside the apartment. Structural damages to the apartment and the common areas are usually covered by the buildings insurance which is included in the separate building service charge.

Building Service Charge:

The service charge is paid to the Management Company which is set up specifically to manage the apartment blocks. Each year the Management Company decides the budget for the year and agrees what services it intends to provide during that year. We have budgeted €2000 (€166/month) for this property but building services charges can range from €2000 – €4000 per annum depending on the standard of luxury and the services required. Depending on your development, your management fees may pay for:

- Repair and maintenance of common areas, car parks, footpaths, roads. Cleaning common areas, windows, carpets/mats, gutters and drains

- Lift repairs and inspections

- Electricity and lighting for common areas

- Landscaping and gardening, pest control

- Security – internal locks and doors, intercoms, external doors and gates

- Safety – smoke alarms, fire extinguishers, health and safety inspections

- Refuse collection and recycling

- Professional charges (for example block/building insurance, public liability insurance, the OMC’s legal/auditor fees)

Management Fees:

Included in this fee is 10% of the monthly rent for property management and tenant management which is usually provided by an outsourced PRSA approved property management company.

Spire will charge a monthly investment management fee of €150 + vat which includes:

- Manage the appointed local property management company

- Review maintenance requests & quotes

- Manage monthly cash-flows receivables and payable. Ensure all rents are maximised at market level where legally possible.

- Manage the accountancy firm and ensure local property, VAT and company taxes are paid

- Ensure compliance with all local regulatory authorities e.g. RTB (Residential Tenancies Board).

- Prepare Bi-annual Investment Reports & manage regular pay-outs to investor (subject to liquidity)

- Act as first point of contact for: Letting agents and property managers, Maintenance Companies, Renovation and construction companies, Investors, Irish Companies Registration Office, Irish Revenue office (tax authorities), Legal advisor, Company accountants & tax advisors

Annual Company Tax returns:

If you receive income from rental properties in Ireland, then you must file a tax return. We have estimated a cost of €1500pa plus vat (€125/month plus vat) for accounting and annual tax returns.

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

What key numbers should considering when investing in a 2 bedroom apartment in Dublin city?

What key numbers should considering when investing in a 2 bedroom apartment in Dublin city?

We’ve done the research on the best locations in Dublin and highlighted the important developments that have successfully worked in the past. All that is required is analyse the key numbers to ensure the returns meet requirements.

For example, lets say we wanted to buy a 2 bedroom apartment in the IFSC, Dublin for a purchase price of €350,000. The acquisition costs would be as follows:

Acquisition Costs

Government Stamp duty:

For residential property, it is calculated at 1% of the purchase price up to €1m.

Legal & Ownership Registration fees:

Some solicitors will charge a flat fee while others will charge a percentage of the house price, usually around 1% or 2%. We have budgeted 1.5% plus vat. This would include the solicitors fees and any extra small land registration charges. Note, we do not use a notary in Ireland. The buyer will have a solicitor and the seller will have their own solicitor.

Independent Building Surveyor:

Surveyor’s fees associated with this type of property are typically based on the time it takes to provide the service. Chartered building surveyors do not typically estimate their fee as a percentage of the property value. They factor in travel time to and from the property, the number of hours spent on the site, and the time spent drafting and finalising the report. It is not unreasonable therefore to estimate €1,500 plus vat for a 2 bedroom apartment.

NOTE- Fit-out:

No fit-out budget or capex is included in the property purchase above. Tenants will typically rent an apartment fully furnished. The apartment will always include kitchens, bathrooms and laminate hardwood floors but investors will need to budget approx. between €5,000 – €10,000 for furniture and some fittings

Broker & Professional Fee’s:

- 6% of the purchase price plus VAT. Included in this amount is the Spire Fee.

- Irish Property Company (“PropCo”) set-up including a PropCo bank account set-up

- Appointment of a resident legal representative (General Manager) of PropCo in Ireland.

- Transfer shares in PropCo. to the new shareholder (the investor)

- Preparing a short-list of previewed & qualified property offers to suit investor criteria

- Tailored Investment Analysis of each property opportunity

- Negotiate purchase price and terms and prepare 5yr investment ROI forecast.

- Co-ordination and review of a technical building report/survey.

- Point of contact for all independent professionals including: Planning and regulations, Property & tenant, Technical property survey, Legal conveyancing, Financial and tax advisors

- Liaise with Prop Co lawyers to ensure legal takeover of the property.

- All local 3rd party property agent fees

- Ensure all Irish Government Stamp Duty and other third-party costs and fees are paid

VAT

Charged at a rate of 23% but is not payable on stamp duty.

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

Is Stoneybatter really the coolest neighbourhood in Ireland?

Is Stoneybatter really the coolest neighbourhood in Ireland?

Smithfield Square & Stoneybatter is a an up-and-coming traditional area bursting with culture receiving big investment on Dublin’s northside . Right on the luas line, these areas boast high-end apartments as well as commercial property. Smithfield Square is a community at the heart of Dublin 7. Come for the culture, stay for the night life. With Dublin city centre on its door step, Smithfield is the perfect place to live, work, wine, dine and be entertained. The Light house Cinema and, the newly renovated Jameson distillery and the Museum of Decorative Arts and History in Collins Barracks are just a few of the amenities located in Smithfield with a plethora of cafes, bars and restaurants.

Until a few years ago, Dublin’s working-class neighbourhood of Stoneybatter and its environs, just north of the river Liffey, were run-down and little talked about. Following a surge of ambivalently received gentrification, Stoneybatter has become synonymous with Dublin hipsterism. Mountain beards and craft beers are de rigueur, and you needn’t look hard to find “hot yoga” venues, art spaces and community squats.

“Stoneybatter named one of the ‘coolest neighbourhoods in the world’ by Time Out magazine”

RENTAL FACTS

- Highly sought-after location with legal professionals for being the central legal hub of Ireland: The Law Society of Ireland, The Bar Council of Ireland, The Four Courts and Criminal Courts of Justice

- Stoneybatter named in Top 50 ”Coolest” places globally

- Excellent transport facilities with the LUAS red line and Dublin Bikes station on the square

- An abundance of amenities on the doorstep such as Jervis Shopping Center and Henry Street

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

Dublin Financial Services District – home to Irelands Top Finance Professionals

Dublin Financial Services District – home to Irelands Top Finance Professionals

The Financial Services Centre is the key hub for finance companies “passporting” their products into Europe,The importance of the International Financial Services Centre IFSC) to the Irish economy is indisputable. It has become one of the leading hedge fund service centres in Europe, and many of the world’s most important financial institutions have a presence here.

Half of the world’s top 50 banks and half of the top 20 insurance companies including Merrill Lynch, Sumitomo Bank, Citibank, AIG, JP Morgan, Commerzbank, BNP Paribas, EMRO and KPMG are just some of the big-name operations that have chosen to locate in the IFSC.

The IFSC is located along the north bank of the river Liffey and spans over a 37.8-hectare area. The IFSC was cleverly developed with a mix of office, residential and leisure buildings. The neighbourhood enjoys an abundance of social and recreational amenities, from water sports and terraced cafés to elegant wine bars and theatre and musical performances in the Three Arena.

RENTAL FACTS

- Brexit financial services companies and workers moving to IFSC

- Huge undersupply of rental units

- Rent increasing faster than normal

- Lowest 2-bed monthly rents €2,100

- Lots of bars, restaurants & cultural amenities

- No new residential developments

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

Why is Dublin’s ‘Silicon Docks’ a desirable investment district for overseas property investors?

Why is Dublin’s ‘Silicon Docks’ a desirable investment district for overseas property investors?

The nickname of the “Silicon Docks” in Dublin has been officially recognised to describe the area where the world’s biggest technology companies have chosen as their European HQ. Facebook, Google, LinkedIn, Salesforce, Airbnb, Amazon, Indeed, TripAdvisor, Accenture, Twitter, Stripe are just some of the growing list of companies that have set up in Dublin, primarily in the Silicon Docks area.

With an area workforce expanding day-by-day, global and local workers have been attracted to this area to fill these highly paid roles, with stories of some of them staying temporarily in hotels during the week, such is the shortage of rental accommodation in this area.

Many of the workers want to live in the area, not just because it is close to their work but it is also a very desirable place to live with may top end restaurants, bars and cultural events that are staged in the Bord Gais Energy Theatre.

RENTAL FACTS

- Massive undersupply of rental units

- Rent increasing faster than averages

- High earning tenants

- Lowest 2-bed monthly rents €2,500

- Lots of bars, restaurants & cultural amenities

- Continuing MNC office growth in 2020 onwards

- Limited residential developments

- Highly sought-after location to work and live

If you are thinking of investing in property as a source of alternative income,

why not contact us today to discuss your requirements in more detail?

Phone: +353 86 325 0048 I Email: info@spirecapital.ie

-

Dublin – one of the best kept property secrets in Europe

Dublin – one of the best kept property secrets in Europe

Rents keep rising as scarcity of properties to rent persists

A massive surge in home-building is needed to stem the relentless rise in rents, latest rental market analysis shows.

The report says 500 new rental properties need to be built every single week for the next three years in Dublin alone — a total of 80,000 over the period.

Report author Ronan Lyons says the solution is to encourage private developers to build and institutional investors to become landlords.That conflicts with the view of many housing rights advocates that the bulk of new homes should be provided by the State through social housing programmes and by non-profit bodies.

Whatever the solution, the problem is clear — there are too few rental properties available to meet the demand and rents are rising far in excess of general inflation, further limiting the choices of hard-pressed renters.

According to the report, from property website Daft.ie, the average monthly rent being paid nationally is now €1,366 but there is huge variation within that figure as it covers both rural and urban addresses and properties of all sizes.

A family needing to rent a three-bedroom house faces an array of different rents depending on where they need to live.

Dublin will present them with the greatest challenge as homes in that category range in cost from €1,671-€2,210 per month in the county areas and €1,780-€2,623 within the city boundary.

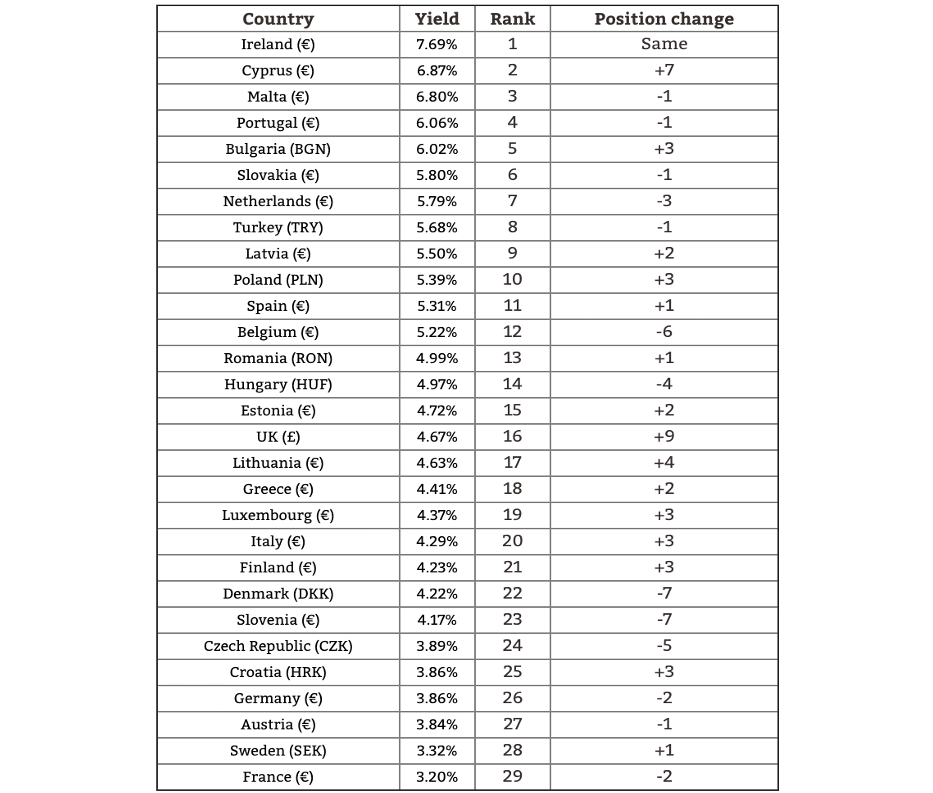

Ireland offers best yield in Europe for buy-to-let landlords

For the third year in a row Ireland has been named the most attractive destination for Europe’s buy-to-let investors. Reasonable property prices, a stable economy and consistent rental demand all add up to make Ireland a very tempting proposition for buy-to-let investors. According to the third annual European Buy-To-Let League Table from WorldFirst, an international payments expert, Ireland is the best destination in Europe for landlords.

Ireland offers an average yield of 7.69%, making it very appealing for investors hoping to maximise rental returns. Hot on its heels is Cyprus, up from 9th place last year to the second slot this time around, while right at the bottom of the table is France, which knocked Sweden off the least-coveted spot.

Ireland’s success is also no doubt helped by the fact that property prices are currently soaring across much of Western Europe. Jeremy Thomson-Cook, chief economist at WorldFirst, says: “Part of the reason for Ireland’s buy-to-let success is while average house prices across the country are on the rise, they still sit some way below the country’s 2008 peak. What’s more, only Malta, Luxembourg and Sweden have experienced higher population growth than Ireland meaning that rental demand continues to go from strength to strength. Add these two factors together and you have a compelling overall proposition for buy-to-let investors”.

Author archive forConor Fitzpatrick

Home/Articles by: Conor Fitzpatrick